Established in the fields of new energy and intelligent vehicle by-wire chassis, Trugo Tech is dedicated to a complete set of core chassis-by-wire technologies and relevant solutions. It has mastered comprehensive proprietary core knowledge of wire-controlled chassis, such as brake-by-wire systems and vehicle stability control systems, maintaining industry leadership. The team is dedicated to the R&D and industrialization of by-wire chassis products, having completed verification of millions of vehicle models, with extensive experience in by-wire chassis industrialization.

Shanghai Watson Rally Automotive Technology Company, Ltd. was founded in 2022 in Shanghai, China. It is an innovative technology company specializing in the research, development, and production of automotive braking systems, focusing on electronic wired braking system (Electro-Mechanical Brake or EMB) and Electronic Parking Brake (EPB). The company is comprehensively equipped to conduct sales, research and development, manufacturing, and after-sales service.Today, Watson Rally is emerging in China’s intelligent chassis industry for its wired braking EMB system.

Linden Chassistech specializes in the design, R&D and manufacturing of automotive shock absorbers in China. Founded by industry experts in the Chinese automotive shock absorber sector, the company is committed to meeting increasingly stringent safety and comfort requirements in the era of electric vehicles through the development of semi-active and active shock absorbers and other critical components, thereby contributing to the Chinese automotive industry. By utilizing fully self-developed automated production lines, it realizes high-quality lean manufacturing in line with the principle of Industry 4.0.

Trensor Co., Ltd. was founded in 2009. It is among the very few pressure sensor manufacturers that possess not only the four core engineering technologies used in pressure sensors (Thick-Film, MEMS, Sputtered Thin-Film, and SOI Micro-Melting), but also the capability to design ASIC chips for their own sensors. Trensor is among the top-ranked manufacturers of pressure sensors in China and abroad in terms of annual output, degree of automation, and industrial chain completeness.

With world-class products, Trensor is among the very few Chinese manufacturers that have been included in the parts procurement system of the world’s top automakers and their Tier 1 suppliers. Around 60% of their revenue stems from exports, mostly to North America and Europe.

Recently, “Zhenling Technology”, an integrated business, financial and legal contract management platform, announced the completion of the series A+ financing of RMB70 million, with additional investment from Blue Lake Capital. It is reported that the company will use the funds raised from this round for market expansion and product development.

Zhenling Technology was incubated by HAND. Its key product is “One Contract Cloud”, a smart management system that covers the entire life cycle of a contract, which includes the efficient contract signing tool OC (OneContract), the contract performance management tool OF (OneFulfill), and the legal affair tool OL (OneLegal).

Currently serving more than 180 customers, Zhenling has signed individual contracts with nearly 100 of them; the proportion of customers acquired by the company individually has also increased from 45% last year to 85%. The company’s customer profile mainly consists of large enterprises with annual revenues of over RMB1 billion and more than 1,000 contracts across the biopharmaceutical, new energy and pan-Internet industries. In particular, a quarter of them are international clients, and the proportion of state-owned and central enterprise clients also increased significantly compared to the previous year.

In 2022, Zhenling’s revenue tripled from the previous year to tens of millions of RMB, with an NDR (Net Dollar Retention) of 120%. The data suggest that most customers are satisfied with its products, and some even made further purchases. Xie Weihu, CEO of Zhenling Technology, indicated that the increase in revenue is mainly attributable to the company’s conscious selection of the “right” customers for cooperation and the improved products.

A company has to have clear customer positioning regardless of the stage it is in. The types of businesses and customers the organisation focuses on directly determines its future development direction; in addition, a sound business philosophy is built on good products. The contract winning rate of OC has increased from 40% last year to 70% this year; OF has also developed new modules for lease contract management, material commitment contract management and risk control management; while OL has optimised the development of class action scenarios and functions. Among the three, OF is gradually becoming a key product that differentiates Zhenling from other companies, accounting for 30% of Zhenling’s total revenue.

The biggest challenge that Zhenling is facing at the moment might be how to scale up sales while maintaining rapid growth. Xie Weihu believes the focus should be on these four aspects:

First, standardising operations to increase scale;

Second, developing products to thoroughly help customers solve problems;

Third, enhancing cooperation within the ecosystem and developing external channels;

Fourth, pursuing high-quality contracts and paying extra attention to the rigidity of demand and ability to pay of customers, as well as the scalability of services.

It is certain that contract management remains to be a premature market where startups can grow to their fullest potential. Looking forward to 2023, Xie Weihu indicated that the company has set a modest goal of continuously achieving twofold growth; while the focus of its products would still be on contracts, with an attempt to adopt a data-driven approach to address the in-depth management needs of customers.

Yifan Zhang, Investment Director of Blue Lake Capital, said that the year 2022 was challenging for startups in terms of business and financing. The team’s capabilities are demonstrated by Zhenling’s treble business growth that exceeded expectations and the completion of a new round of financing despite under a difficult environment. The company’s products have achieved a major breakthrough in 2022, and has built a good reputation and entered a rapid replication stage after securing benchmark customers from some vertical industries. We are looking very forward to the development of Zhenling in 2023.

Blue Lake Capital exclusively led the angel round of financing of nearly RMB30 million for Zhenling Technology. In six months, Zhenling Technology announced the completion of its series A financing of RMB53 million, with additional investment from Blue Lake Capital.

Shenzhen SENSING Technology Co., Ltd. has recently completed the Series A financing of nearly RMB100 million in investment jointly led by Blue Lake Capital and Richen Capital.

Founded in 2018, SENSING is dedicated to providing in-vehicle smart cameras with optimal imaging technology for autonomous driving. Its products covers high-performance camera modules, image solutions, and ISP algorithms.

With the strong trend of new energy vehicles and rapid adoption of high-level autonomous driving solutions in recent years, new opportunities have emerged upstream and downstream along the finished automobile supply chain for modules and parts manufacturing startups. AI applications such as intelligent vehicles, autonomous driving and robotics (especially in the autonomous driving scenario) require high quality imaging, which take strong capabilities of the suppliers in engineering, image debugging, service response and supply chain to achieve. Visual sensors, being the eyes of various smart applications, boast demand reaching hundreds of billions of dollars.

Built on its strong R&D capability as a core strength, SENSING has created an industry-leading product line in the field of car cameras. Camera modules from SENSING offer the broadest solutions with the highest compatibility with in-vehicle computing power platforms on the market. Meanwhile, with profound industrial technological expertise that its R&D team possesses, SENSING is also able to develop ISP image processing algorithms on its own and build a unique hardware and software ecosystem gradually.

The company’s products are currently applied in front-view L2/L2+, unmanned delivery vehicles, smart terminals, smart mines, Robotaxi, robots, V2X cameras and many other application areas.

Starting from serving customers in the autonomous driving scenario, SENSING has continued to enhance its abilities by upholding high-quality production and outstanding quality control, and established a unique position and foothold in the market. Thanks to the upsurge of market demand and the relentless effort made by its team, the company has gained a remarkable industry reputation over the past three years.

With excellent image capability, SENSING is also an Elite-level partner of NVIDIA in China, and its technologies are widely adopted in front ADAS for robots, passenger cars and commercial vehicles.

Going forwards, SENSING will continue to devote itself to the field of autonomous driving and strive to become an integrated high-tech enterprise that excels in high-end camera module R&D, design and manufacturing as well as image quality algorithm development in order to provide high-quality perception technology for autonomous driving.

Haitao Wei, partner of Blue Lake Capital, said that the successful investment in SENSING marks a significant achievement for Blue Lake’s upstream exploration of the intelligent driving industry chain. Having engaged with the company for over a year, we have seen its team’s insightful business strategies and good cohesiveness and execution in implementing them. We are confident that the company will achieve its vision and missions of becoming the leader in the intelligent driving and visual sensing industry.

Richen Capital is pleased with SENSING’s robust and all-round team that keeps enhancing its capabilities to expand its product line and application scenarios and provide both new and existing customers with the best products and services.

Blue Lake Capital has been closely following developments of new energy vehicles and driverless cars in recent years, actively investing in promising upstream and downstream startups in the industry chain. To date, Blue Lake Capital has invested in a number of industry leaders, including Momenta and Xizhi Technology. It supports outstanding startups as an investor, entrepreneur and operator based on insightful industry research to jointly set industry benchmarks with them.

In October 2022, Ray Hu, Founder and Managing Partner of Blue Lake Capital, shared his view as a mentor on the development strategy, business management and product concept of Dark Horse Enterprise, a SaaS company, as well as the investment and financing environment for the SaaS segment and coping strategies.

01: SaaS is still the most attractive business model at present

Over the past year and a half, the financing environment for the SaaS segment has undergone unprecedented changes, and valuation fluctuations of the SaaS industry in the secondary market are the direct cause.

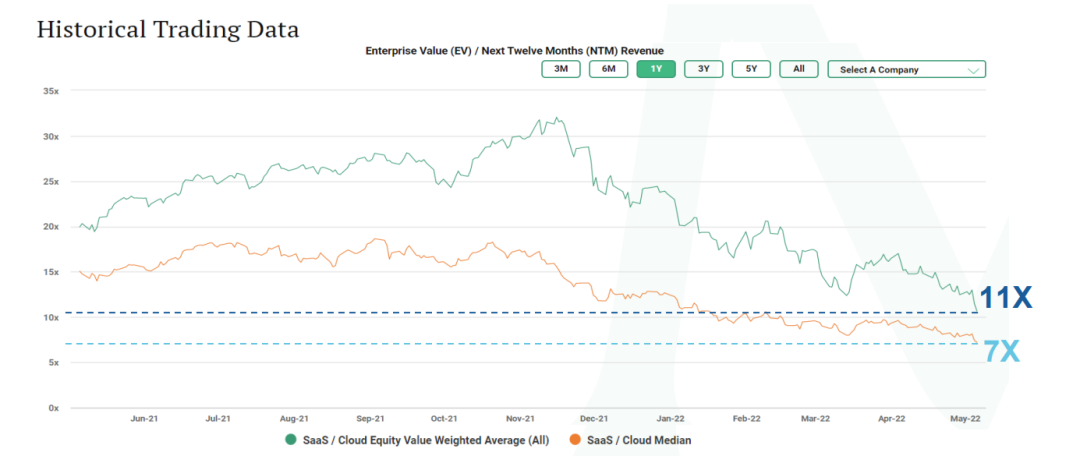

In the secondary market, price-to-sales ratios are usually used to calculate the median valuations for software companies. As shown in the figure below:

We can see that the valuation of the SaaS industry reached its peak at the end of 2021, with the average being close to 30 times the price-to-sales ratio and the median being close to 15 times the price-to-sales ratio. In 2022, the valuation of the SaaS industry in the secondary market returned to 8-10 times the price-to-sales ratio. This valuation is relatively reasonable in the long run, but such a change has caused confusion and given rise to a cautious sentiment in the primary market and severely undermined the confidence of many entrepreneurs.

In fact, from a long-term perspective, volatility in the capital market is almost inevitable. For a particular business type, short-term sentiment changes in the capital market are not at all representative of long-term market trends of such business. Actual market data show that whether in the United States (U.S.) or China, most listed software companies have been able to maintain a growth rate between 20-30%.

Therefore, the fact that the entire software segment is still growing at a high rate remains the same regardless of how we change the investment valuation mechanism for the primary market and secondary markets,

02: Facing up to the SaaS valuations, and focusing on the long-term business value

A managing partner from a leading U.S. fund has an interesting piece of advice for software entrepreneurs in the midst of valuation fluctuations in the SaaS capital market: forget the market valuations last year.

Software companies should prioritize long-term business growth and profitability at the development stage. In particular, many SaaS startups are still in the early stage of development. Founders should pay particular attention and think about how to lay a solid foundation for long-term revenue growth and profitability at this stage.

In terms of the business itself, SaaS software is still a very attractive business model in both the U.S. and the Chinese markets. Even during the stage of rapid growth, SaaS software remains a high-margin business. Business models with both high gross profit and fast expansion like this are still rather uncommon in the entire market.

Moreover, SaaS software revenue is an ongoing revenue, specifically the annual subscription fee that customers pay to use the auxiliary software. The implicit assumption behind this is that once user stickiness is developed, SaaS companies will have a high renewal rate. This is the indirect reason why quality SaaS software can easily build a strong market dominance.

Therefore, SaaS founders can still cultivate excellent investment targets by facing up to the constantly changing market valuation mechanism, refocusing on the business itself and patiently improving their products.

03: Product intelligence is a crucial consensus for SaaS startups in the face of fierce competition

There are some obvious distinctions between the U.S. and Chinese SaaS markets: the Chinese market is far more competitive than the U.S. market.

In China, a segment that is only partially validated can instantly swarm with dozens of companies competing in a homogeneous manner. As a direct result, the unhealthily low unit pricing is troubling the domestic SaaS market. However, there are workable solution to this issue. When the concentration of a certain market segment gradually increases, there will be more room for price rises. More importantly, China’s SaaS customer base is unmatched by the U.S. or any other market in the world.

The market itself is changing at the same time. According to our observation, customers are less concerned with the concept of SaaS products but concentrate on the functionality and security of SaaS products, as well as the importance of paying attention to local development. From the perspective of entrepreneurs, there is a very obvious trend that the software products are advancing in terms of intelligence and applicability, and more and more products are centered around the end user and become more segmented and more specialized. Product intelligence, in particular, is more fundamental, which directly affects the application applicability of products and the degree of specialization of a partial function. It is an important prerequisite for products to stand out in the future market.

Therefore, developing intelligence for SaaS products and patiently pursuing PMF (Product Market Fit) have come to be a consensus in the industry amid intense local competition.

Finally, let’s sum it up:

First, SaaS entrepreneurs should be customer-oriented and prioritize the needs of customer. Second, they should persevere and understand that building a software-based business is like a long-distance race. Third, they should be good at money management. What the founders have to do is to stay calm and concentrate on implementing the above ideas in the actual business operation.

The United Nations-supported Principles for Responsible Investment (PRI)

The UN PRI, the world’s first organisation to promote environmental, social, and governance (ESG) investing, seeks to guide responsible investors to build and expand sustainable markets for shared success on issues including climate actions and the UN Sustainable Development Goals (SDGs).

Recently, Blue Lake Capital joined the UN PRI’s list of signatories.

This means that Blue Lake Capital will commit itself to upholding the world’s highest standards and implementing ESG investing practices while remaining steadfast in its pursuit of mutually beneficial outcomes for the interest of investors as well as the socially and environmentally sustainable development goals.

The PRI is an investor initiative launched in partnership with the UNEP Finance Initiative (UNEP FI) and the UN Global Compact (UN Global Compact) in 2006. It is the first organisation to put forth the idea of linking “responsible investment” to ESG considerations and advocate “a strategy and practice to incorporate ESG factors into investment decisions and active ownership”.

After signing the PRI, Blue Lake Capital will adhere to the six principles for responsible investment established by the UN PRI and take these factors into account when considering and making investment decisions. These principles will serve as an important basis for evaluating investment opportunities and supporting the growth of our invested companies.

Six principles for responsible investment:

- Incorporate ESG issues into investment analysis and decision-making processes;

- Seek disclosure on ESG issues by the entities in which we invest;

- Incorporate ESG issues into our ownership policies and practices;

- Focus on the investment industry chain and promote acceptance and implementation of the principles for responsible investment within the investment industry;

- Work together to enhance our effectiveness in implementing responsible investment;

- Ask signatories to report on their activities and progress towards implementing the principles for responsible investment.

Besides, Blue Lake Capital will have an impact on how our invested companies improve the management of ESG (environmental protection, social responsibility and corporate governance) issues and push forward with the development of ESG frameworks and related policies, guiding them to become stronger businesses with higher values and the capability to grow sustainably in the long run.

Blue Lake Capital focuses on technology innovators in China’s digital transformation and upgrading, primarily investing in early-stage entrepreneurs in two major sectors: enterprise software and intelligent manufacturing. As the world struggles with common issues related to sustainable development, we as asset managers will continue to uphold our social responsibility by working to share long-term sustainable investment returns with investors and to achieve outcomes that are beneficial to investors, society, and the environment.

In the recent 2022 ESG (EqualOcean Summit for Globalization), EqualOcean released the list of 2022 top 50 China SaaS companies based on yearly industry and investment research, high-level interviews, published rankings and reports, key business indicators and expert scores.

The list includes as many as eight companies in Blue Lake Capital’s SaaS portfolio, namely Leyan Technologies, Moka, Cloud Helios, Lingxing Technology, Zhenyun Technology, Jushuitan, Zaihui and Thinking Data (not in an order of priority). They cover a wide range of business areas such as marketing, HR & HCM, ERP, fintech & tax and vertical industry integration, testifying Blue Lake Capital’s comprehensive and in-depth deployments in the SaaS sector.

After more than two decades of development, the global SaaS industry is estimated to be worth hundreds of billions of US dollars, with huge potential in its business models of low-cost subscription with fast iteration.

China’s SaaS industry is in rapid development where new market opportunities arise from constant innovation in products and business models and fast-changing competitive landscape and use cases. In particular, the pandemic has added tremendous momentum to digitalization that would otherwise take 30-50 years to achieve.

As a venture capital firm driven by both industry research and business experience, Blue Lake Capital focuses on business value amid opportunities and challenges in the current market to work with excellent SaaS start-ups as an investor, entrepreneur and operator all at the same time.

We expect to see more SaaS companies in Blue Lake Capital’s portfolio become unicorns or hidden champions in the industry, which will bear witness to epic opportunities brought by China’s digitized innovations and upgrades.

Polymaker is a brand owned by Suzhou Jufu Polymer Materials Co., Ltd., a high-tech enterprise specialising in 3D printing materials. The company is committed to promoting the use of 3D printing technology in various industries by offering cutting-edge technology, high-quality goods, and thoughtful services. Nowadays, Polymaker has grown to be a world-class innovator and supplier of extruded 3D printing materials. Its products are sold all over the world and have been used in a wide range of industries including automobiles, aerospace, industrial manufacturing, medical services and daily necessities.

Avove Electronic integrates materials in the upstream and modules, components and accessories in the midstream in the advanced electronics manufacturing chain, striving to develop into a high-tech platform with global influence and technological leadership in comprehensive consumer electronics solutions in China.

Headquartered in Jining, Shandong Province with a registered capital of RMB1.046 billion, the company is committed to technological innovation and product platform construction, and delivery of high-quality products and services to top-tier customers.

Dongying Cospower Technology, whose predessor is the Hong Kong-listed Coslight Technology International Group Ltd. (01043.HK), one of the first lithium battery manufacturers in China, embarked on a new journey after the company’s team undertook all of the energy storage business under Coslight Technology International Group Ltd. in the form of MBO.

It has established a complete sales network worldwide, with branches in India, Korea and Russia. After years of dedicated development and efforts, the company has delivered 1.2 million units of energy storage systems with a normal life span of up to eight years.

Established in April 2014 and headquartered in Suzhou, Suzhou Itimotor Automotive Technology Co., Ltd. is a third-party testing organisation specialising in testing services, test equipment and engineering consultancy.

Its services cover complete vehicles, engines, transmissions, electric vehicles (batteries, motors and electric control components), hydrogen engines, hydrogen fuel cell engine systems and components, power assembly and intelligent driving. The company now has more than 400 sets of test benches of various types, and nearly 500 expert engineers and test team members.

Founded in 2018, Shenzhen Senyun Intelligent Technology Co., Ltd (“Sensing”) is dedicated to producing high-quality imaging products for autonomous driving. Its core team, which has more than 10 years of experience working in well-known auto companies specialising in intelligent driving and automotive electronics, has concentrated on the development of automotive intelligence since the company entered the automotive industry in 2004.

Suzhou Xizhi Technology Co., Ltd., a high-tech company specialising in third-generation semiconductors, was incorporated in October 2017. It is committed to becoming a world-class manufacturer of automotive-grade power and power module components.

In less than a year after it began operations formally in October 2021, it had received RMB110 million of financing from the angel and angel+ rounds, and been recognised as the Leading Growth Enterprise in Suzhou Industrial Park and the Major Technology Investment Project in Suzhou Industrial Park.

简单云是由一批来自百度、华为、IBM、金山云等公司,长期从事企业研发效能领域的业务专家团队创建。简单云专业从事企业研发效能领域,不断钻研底层技术,不断用技术和产品创新来推动企业研发效能提升,助力企业业务成功,让世界感受到中国的软件工程工具的力量。

公司自成立以来,获得了业界的普遍赞誉和荣誉:2020年受聘为信通院DevOps标准制定专家单位、2021年受聘为信通院可信云标准制定专家单位;自有产品全系自研、拥有多项核心技术专利及十余项软件著作权;荣获GOPS2020年度明星产品奖;信通院2021年度云原生技术创新大奖;先后通过可信云Devops工具先进级认证、企业信用AAA级认证、ISO9001、ISO27001、ISO20000、中关村高新技术企业、海淀区重点支持胚芽企业等认证。截至2021年9月, SaaS版已经注册数千家企业,私有部署版本已经签订总计千万人民币订单。

IntraMirror创办于2017年,是一款专门服务于全球买手选货平台的APP,由原LV集团高管,国内顶尖奢侈品电商总裁,知名跨境电商创始人,以及阿里巴巴高管联合创立。IntraMirror作为专门为同行服务的奢侈品供货平台,公司目前与近60家全球权威买手店合作,系统商品库存同步,实现一键购买全程供应链支持。

Zelos is an AI based and innovation driven startup and pioneer in the autonomous driving technologies, with the focus on the research and development of the AI centric software and hardware. Zelos provides optimial business models, infrastructures and solutions for the intra-city autonomous transportations.

Follow us on Wechat