Empower Intelligence (嘉强智能), a portfolio company of Blue Lake Capital, has recently completed its Series B financing round totaling hundreds of millions of RMB. The round was led by the Industrial Machinery Industry Investment Fund (工业母机产业投资基金), co-led by CRRC Transformation and Upgrading Fund (中车转型升级基金), Hidden Hill Capital, and Vision Plus Capital, with participations from North Venture Capital Fund (北创投基金), Bank of Communications Overseas Chinese Fund, and Lingang Digital Technology Fund (临港数科基金).

The new funding will be allocated to pursue Empower’s HONGZHI RUI xEOS Platform and the KAIYUAN xAPP mini-program ecosystem, designed for edge deployment in laser intelligent equipment. This investment will not only accelerate R&D team development and expansion and the establishment of digital smart manufacturing delivery centers, but also enhance Empower’s integrated software and hardware offerings and global service capabilities. Furthermore, the funding will support the expansion of downstream industry application solutions to meet the increasing demand for laser automation across various industries.

Globally, industrial laser machine is extensively penetrating and replacing traditional processing machines, emerging as the new generation of “industrial machine tools”. Currently, China’s laser manufacturing equipment market has already exceeded 100 billion RMB. Following trends in core component performance optimization, cost reduction, and increasing smartification, application scenarios such as cutting, welding, cladding, additive manufacturing, cleaning, and micro-processing are rapidly expanding. The market scale is poised for further substantial growth.

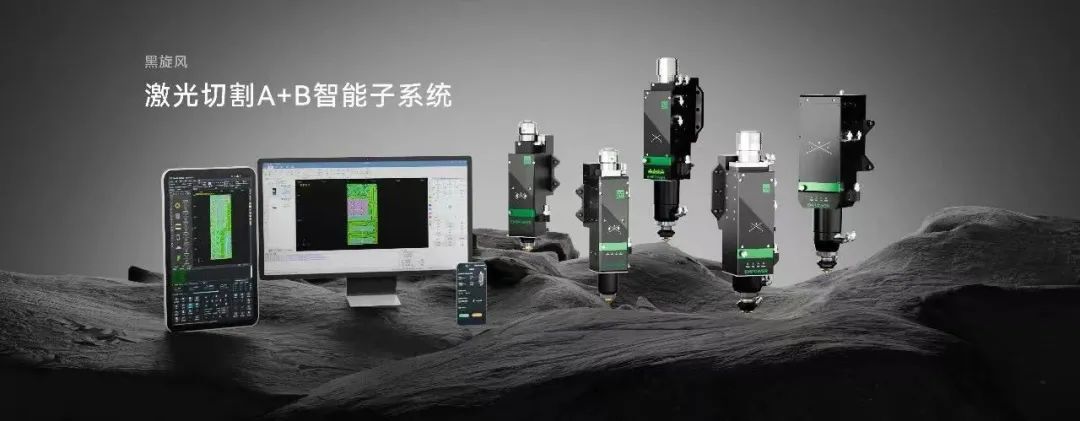

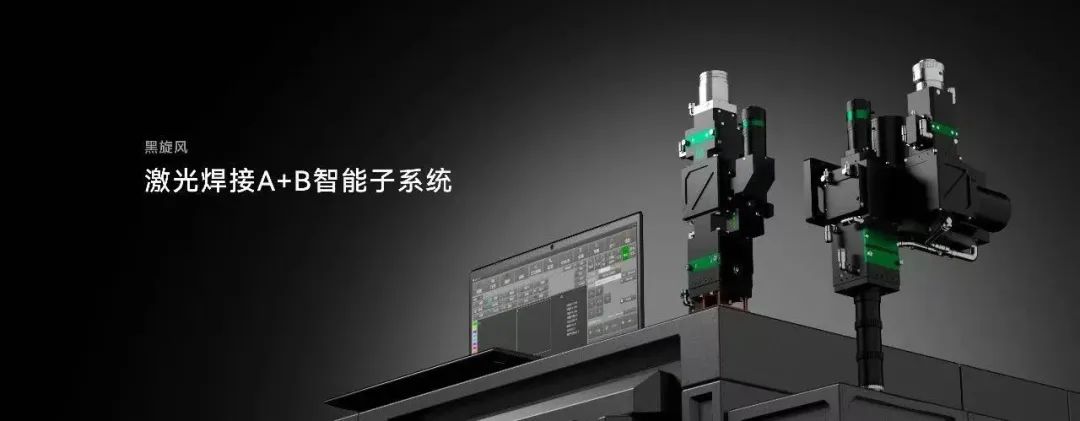

As a global leader in core subsystems for laser equipment, Empower Intelligent provides integrated hardware and software solutions combining CNC systems and laser processing heads (A+B), modular K+N industry solutions, and full-stack C+S services covering the entire product lifecycle.

Empower Intelligent, as China’s first manufacturer to achieve domestic substitution of laser processing heads, maintains its leading position in domestic sales with cumulative deliveries over 200,000 units. The company’s market presence extends to over 20,000 downstream customers, achieving a coverage rate exceeding 90% among leading laser equipment manufacturers, with products distributed across more than 70 countries and regions globally. The company has earned numerous prestigious recognitions, including the “Specialized, Refined, Distinctive and Innovative” Little Giant designation from the Ministry of Industry and Information Technology, National High-Tech Enterprise status, Shanghai Manufacturing Single Champion Enterprise, Shanghai Science and Technology Little Giant, and Shanghai Enterprise Technology Center certification.

In June 2022, Blue Lake Capital was the lead investor in Empower Intelligence. With the widespread use of laser technology in industrial applications, Empower has established itself as an undisputed hidden champion in core subsystems for laser equipment. The company has made significant progress in expanding its control software capabilities, gaining recognition from downstream customers across various application scenarios.

Source: Empower Intelligence

Shanghai Trugo Automotive Technology Co., LTD. has recently announced the completion of a 400-million-yuan Series B financing. The investors of this round include Blue Lake Capital, FAW Equity Investment (一汽股权投资), Fortune Capital (达晨财智), SinoKing Capital (清控金信), FIBONACCI VC (千乘资本), Winreal Investment (容亿投资), UOB Venture Management (大华创投), Guangzhou Development District Industry Fund Investment Group Co., LTD., Changshu Guofa Venture (常熟经开国发), Baolong (保隆科技), Auto Capital (鳌图创业基金).

As the dark horse in chassis-by-wire technologies, Trugo Tech has been leading the field of domestic brake-by-wire systems since 2022, with more than 100% performance growth for three consecutive years. With a mature product heritage and leading technical capability, Trugo Tech has won the favour of more than 50 designated projects from 11 OEMs.

Based on the accumulated experience of industrializing more than 6 million sets of intelligent vehicle by-wire chassis products, Trugo Tech has accomplished the million-level shipment of brake-by-wire products and achieved a milestone of the No. 1 shipment of independent ESCs in China.

The star product EHBI-Onebox electro-hydraulic braking system has been capable of mass production and supply and has been designated by nearly 10 well-known mainstream OEMs for their key projects. Trugo Tech will maintain the excellent industrialization level of the domestic ESC/Onebox markets and lead the development of brake-by-wire technologies.

China has achieved a significant first-mover advantage in the field of new energy vehicles. Besides, the huge automotive industry chain is facing a transformation of intellectualization, involving urgent breakthroughs and upgrades of key subcomponents.

As a result, Trugo Tech has gradually strengthened its independently controllable capability and R&D capability in the supply chain. At the same time, it is collaborating with the upstream supply chain to complete the R&D and industrialization of core components. Trugo Tech is accelerating at an impressive “Chinese speed” under the requirements of reshaping the supply chain to realize the increase of the localization rate of subcomponents, autonomous mastery of core automotive parts and continuous innovation, and continuous upgrading of industrialization capacity to meet the market demand.

In terms of chips, Trugo Tech has started strategic cooperation with many famous automotive customers and gradually realized production. In terms of school-enterprise cooperation, Trugo Tech, SAIC-GM-Wuling, Wuhan University of Technology, and Baolong jointly set up the “Joint laboratory of intelligent chassis-by-wire” to accelerate the realization of the key breakthroughs in chassis-by-wire technologies.

Jingjie Chen, the founder and CEO of Trugo Tech, said, ‘Trugo Tech always insists on steady and continuous cultivation in the field of wire-control chassis. In the face of higher requirements of customers, Trugo Tech would make the superb products of chassis-by-wire. In the face of intense competition in the market, Trugo Tech would push forward the localization of parts and reshape the supply chain, and build the No.1 brand of chassis-by-wire. In the face of changes and opportunities in the automotive industry, it is necessary to deepen the cooperation with the upstream and downstream partners of the industry chain, and undertake the responsibility and mission as a domestic core auto parts supplier. Thanks to the support and trust from the investment partners that work with Trugo Tech to promote technological progress and industrial upgrade of the automotive industry in China. As well as striving for the comprehensive rise of this industry.’

It is reported that Blue Lake Capital led Series A+ financing for Trugo Tech in June 2023 and firmly raised its stake in Series B financing this time.

Contents source from: Trugo Tech

On December 10th, Forbes China released the ‘Forbes China Venture Capitalists 100 of 2024’ list. Ray Hu, Founder and Managing Partner of Blue Lake Capital, was honoured to be on the list.

Until 2024, Forbes China has conducted independent research on venture capitalists who actively participate in the China mainland market for 18 years consecutively. After that, they identified 100 venture capitalists who had achieved good returns in the past five years among a sample of nearly 1,000, with referrals from hundreds of VC firms.

As a venture capital institution that has been established for ten years, Blue Lake Capital has laid a solid foundation in the field of science and technology venture capital after years of intensive cultivation under the leadership of Ray Hu. In particular, it has made considerable achievements in investments in autonomous driving, new energy vehicle industrial chain, industrial digitalization, etc.

Images source from: Forbes China

Zelos, a portfolio company of Blue Lake Capital, has successfully secured $100 million in its Series B1 funding round. The round was co-led by Blue Lake Capital and CDH BAIFU, with participation from existing shareholders. This financing round marks one of the largest investments in the autonomous driving sector in the past year.

As a leading global developer and applicator of autonomous urban delivery products, Zelos boasts in-house development capabilities for full-stack Level 4 self-driving technology. The innovator has successfully commercialised its solutions on public roads, making it the first unmanned urban delivery firm in the industry to achieve profitable operations through a “turnkey vehicle sales” model.

With robust foundational systemic capabilities in Level 4 algorithm development, product creation, vehicle delivery, and marketing operations and maintenance, Zelos has achieved complete in-house development of its core hardware and software modules, building three major technology platforms: an intelligent platform, a vehicle platform, and an electrification platform. The company’s latest unmanned vehicle model features comprehensive upgrades in its hardware and software capabilities, including enhancements to the computing units and sensors. Equipped with a high-performance, automotive-grade dual Orin Drive computing platform, the vehicle delivers over 500 TOPS of processing power. Built on the proprietary ZOE 2.0 architecture, it optimises sensor integration and expansion while enhancing data transmission density and processing efficiency. Meanwhile, Zelos has achieved unified detection of dynamic and static obstacles, as well as map elements, through its backbone network and Transformer technology. By integrating a leading pre-decision model, the system enables end-to-end decision-making that adapts to various complex conditions and scenarios, including rainy or snowy weather, intricate intersections, tunnels, and elevated bridges. Its key performance metrics are among the best in the industry.

Leveraging its robust whole vehicle design capabilities and deep understanding of urban delivery scenarios, Zelos has rapidly iterated five vehicle models within just a year and a half of its establishment. In the fourth quarter of 2023, it officially launched the world’s first mass-produced Level 4 urban delivery vehicle – the Zelos Z5 series. This groundbreaking development ushers in a new era of vehicle sales for L4 autonomous urban delivery products, enabling large-scale commercial applications across various public road delivery scenarios in multiple cities.

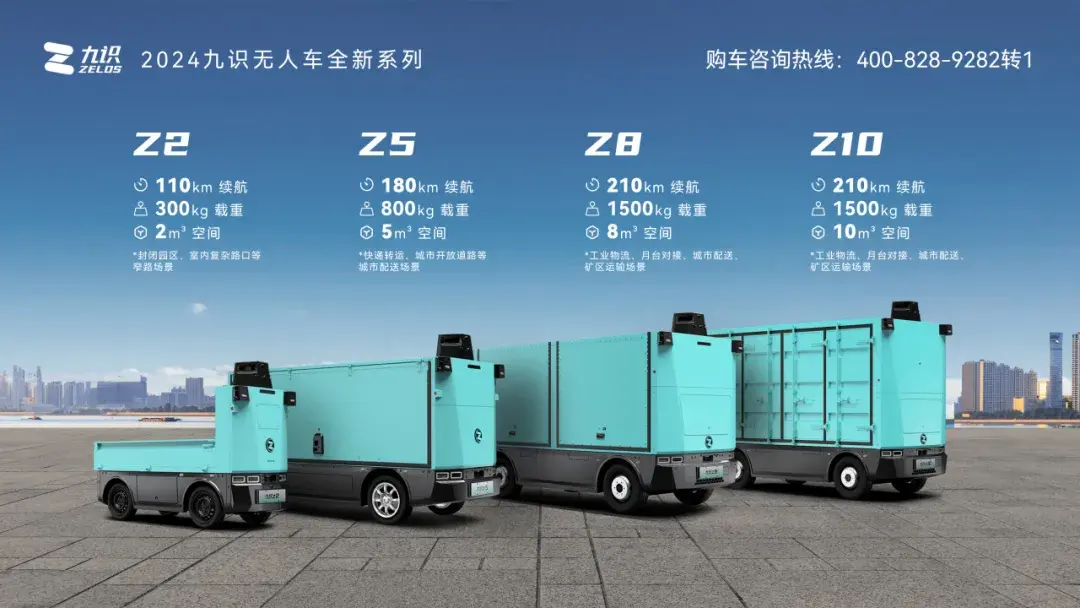

To address the varying demands of logistics sub-segments, Zelos continues to evolve its product offerings. In June 2024, the company introduced four new Level 4 driverless vehicles: the Z2, Z5, Z8, and Z10, each designed to accommodate different scenarios and cargo capacities: the flagship Z5 model is ideal for B2B delivery scenarios, including express logistics, fresh produce, and pharmaceuticals; the compact and agile Z2 is designed for narrow environments, such as enclosed zones and complex indoor intersections; the Z8 features high endurance and heavy payload capabilities, making it suitable for long-distance transport in industrial logistics, rural express delivery, and mining operations; building on the Z8, the Z10 further enhances endurance, volume, and payload capacity, positioning it as the largest unmanned delivery vehicle in the industry.

Currently, over 1,000 Zelos unmanned urban delivery vehicles are operational across more than 130 cities, having completed over 100 million deliveries. This deployment has enabled customers to achieve an average reduction of 62% in operational costs. In this process, the team has accumulated over 4 million kilometres of actual Level 4 autonomous driving operations, with a current monthly increase of approximately 1 million kilometres. The enterprise is now delivering products to customers at a pace of several hundred vehicles per month.

Meanwhile, Zelos is actively advancing its global strategy and has secured the first unmanned logistics vehicle licence issued by Singapore’s Land Transport Authority. The company is now conducting automated operations on designated public roads in the country. In addition, it has participated in the development of the TR-68 self-driving technical standards by the Singapore Standards Council, as well as collaborating with regulatory authorities to establish testing protocols for unmanned logistics vehicles operating on public roads, addressing gaps in local regulations and promoting the widespread adoption of self-driving technology. Recently, the firm has secured orders in Malaysia, Japan, and the Middle East, marking a significant step for domestic autonomous driving products as they make their way into international markets.

Haitao Wei, Partner of Blue Lake Capital, stated, “The smart driving sector is entering a critical window for large-scale commercialisation. Since Zelos’s inception just three years ago, Blue Lake Capital has witnessed its remarkable evolutionary capabilities, strong product development, and effective commercialisation, successfully establishing operations in multiple cities across the nation while methodically expanding its international presence. In this round of financing, Blue Lake Capital has once again reinforced its commitment, reflecting strong confidence and support for the team. We remain optimistic about Zelos’s ability to enhance industry efficiency through its superior product capabilities and to create tangible value for society. We believe that it will bring more positive momentum to the industry, accelerating the adoption of smart driving across a broader range of applications.”

Blue Lake Capital was the lead investor in Zelos’s angel round of financing in January 2022 and has continued to elevate its investment in subsequent Pre-A and A rounds.

Image Credit: Zelos

The 2024 Blue Lake Capital Annual General Meeting (AGM) was successfully held in Shenzhen on 18 September 2024.

The AGM featured global institutional investors and representatives from Blue Lake’s outstanding portfolio companies, who engaged in in-depth discussions on industry changes and developments in advanced manufacturing, corporate digitization, and cross-border e-commerce within today’s complex and dynamic economic environment. The focus was on fostering deep integration between industry and capital to promote collaborative development and value creation.

Haitao Wei, Partner of Blue Lake Capital, delivered a presentation titled “Electric Vehicle: An Emerging New Eco System”.

Thanks to cleaner technologies and lower costs, the transition of China’s automotive industry to electric vehicles seems unstoppable. The penetration rate of electric cars in total sales continues to rise, reaching 36% in 2023 and surpassing 40% in the first half of 2024.

This transformation mirrors the disruption of traditional mobile phones by smartphones years ago. The transition incorporates various new technologies, including innovative software layers, chips, sensors, and chassis technologies, creating numerous new opportunities within the automotive supply chain ecosystem.

Since 2016, Blue Lake Capital has been making significant investments focused on the trends of electrification and smart technology in the automotive industry.

In the autonomous driving algorithms sector, Blue Lake Capital led the angel round investment in Momenta, a global unicorn specializing in L3/L4 autonomous driving solutions, and in Zelos, a producer and operator of L4 commercial unmanned urban delivery vehicles. In the chassis components sector, the Fund has invested in several key players, including TEEMO, a leading provider of autonomous driving skateboard chassis; Linden, a manufacturer of CDC shock absorbers; Trugo Tech, a manufacturer of brake-by-wire systems; and Watson Rally, a pioneer in electromechanical braking (EMB) system. In the sensor and detection systems sector, the Fund has invested in several key manufacturers, including Sensing, a producer of L4 high-definition cameras; Trensor, a manufacturer of pressure sensors; and Itimotor, a supplier of automotive powertrain testing systems.

For original equipment manufacturers (OEM) and the supply chain, the transition from fuel vehicles to electric vehicles presents a significant opportunity. Over the past five years, Blue Lake Capital has built a robust portfolio in this sector, with most of its portfolio companies receiving decisive investment from the Fund during Series A round or even at the incubation stage. The Fund’s electric vehicle investment portfolio has capitalized on the tailwinds of rapid growth amid disruptive changes in industry.

While maintaining an optimistic outlook on the industry, Blue Lake’s team has also noted the potential for overcapacity. Moving forward, Blue Lake will adopt a more cautious approach in selecting niche segments and will place greater emphasis on exit opportunities and real DPI during post-investment management.

Dr. Ye Guohong, Founder and CEO of Linden Chassistech, represented the Fund’s outstanding portfolio companies and shared insights into Linden’s entrepreneurial journey and the trends in the electric vehicle components industry.

Established in July 2023, Linden Chassistech specializes in the design, R&D, and manufacturing of automotive shock absorbers in China, along with finished vehicle matching and tuning.

Dr. Ye believes that the rapid increase in electric vehicle penetration in China has created new demand in the smart chassis market. The introduction of advanced autonomous driving technologies (Level 3 and above) requires chassis systems with enhanced controls. The total passenger car market in China is expected to grow to 30 million vehicles by 2030, with the electric vehicle market accounting for 22 million units. The substantial market opportunity has attracted many emerging OEMs, leading to predictions that the peak market size for CDC shock absorbers—key components in electric vehicles and autonomous driving—could reach RMB 18 billion, with a global market size of USD 6 billion.

In response to this historic entrepreneurial opportunity, Dr. Ye and his team made the decisive choice to start their venture, delivering impressive results in a short period. Since September 2023, they have established deep collaborations with several OEMs. In October 2024, an automatic assembly line with an annual production capacity of 1 million electromagnetic valves and a semi-automatic assembly line with an annual production capacity of 1 million shock absorbers will soon be put into operation.

Ray Hu, Founder & Managing Partner of Blue Lake Capital, presented on “SaaS: The Forever Software”, sharing Blue Lake’s perspective on the SaaS industry within the economic cycle and providing updates on the business progress of its SaaS portfolio.

Although the BVP Emerging Cloud Index (EMCLOUD) declined by 8.4% from July 2023 to July 2024 (while the Nasdaq Index rose by 17.5%), operationally, the ARR growth median of US listed SaaS companies during the same period was 17%, with a median NDR of 110%. This demonstrates the strong resilience of SaaS businesses throughout the economic cycle. We firmly believe in the powerful advantages of the SaaS business model and its immense potential in the Chinese market.

In view of the valuation adjustments in the secondary market, Blue Lake Capital leverages its team’s long-term industry resources and deep business insights to focus on post-investment empowerment. This involves assisting portfolio companies in identifying clear path to cashflow breakeven, thereby accelerating their business growth, consolidating market leadership, and patiently awaiting optimal exit opportunities.

Nearly 70% of the companies in Blue Lake’s SaaS portfolio are expected to achieve positive quarterly cashflow by the first half of 2025, with Jushuitan projected to attain profitability in 2024 and already in the process of an IPO in Hong Kong.

SaaS companies can achieve long-term stable growth while maintaining gross margins exceeding 70%. The market headwinds of the past two years have created undervalued investment opportunities. The Blue Lake team will patiently await the right moment while strengthening post-investment management to empower portfolio companies’ product capabilities, ensuring they remain competitive in the market. Blue Lake believes that by bracing themselves for upcoming challenges, they will not only achieve a smooth landing but also soar to another new height.

Haohui Chen, Partner of Blue Lake Capital, presented on “Cross Border E-Commerce: New Face of China’s Trade”, discussing Blue Lake’s investment strategies in the cross-border e-commerce sector and the key success factors of its outstanding portfolio companies.

In the wake of the pandemic and changing consumer habits, e-commerce has been thriving in China, and the penetration rate in major global economies is steadily increasing. For example, in the U.S., the e-commerce penetration rate rose from 11% to 16% over three years. Cross-border e-commerce has become a new engine for China’s foreign trade growth, with sales reaching RMB 1.8 trillion in 2023 and expected to hit RMB 2 trillion in 2024, representing a compound annual growth rate of 20%.

Since 2018, Blue Lake Capital has focused on the cross-border e-commerce sector, gradually developing a deep understanding of the market through two early investments. This has allowed them to identify high-potential niche categories and uncover investment-worthy targets within the space.

Chen believes that these targets typically possess three key characteristics: a thorough understanding of the rules and dynamics of various e-commerce platforms; a first-mover advantage in high-potential categories; and a position among the leading players in those categories.

The four companies in Blue Lake’s cross-border e-commerce portfolio—tools and equipment brand Vevor, sportswear brand Baleaf, smart lighting brand Govee, and 3D printing filament brand Polymaker—are all top sellers on Amazon. Blue Lake identified and invested in these companies during their early development, and since then, they have maintained rapid business growth, demonstrating both strong growth potential and profitability.

Chen stated that since export through direct to consumer cross-border e-commerce has demonstrated strong historical growth and future potential, and given that Blue Lake has already invested in outperformed companies, Blue Lake’s USD-denominated Funds (USD Funds) will continue to closely monitor this space. Additionally, the Blue Lake team will maintain its rigorous selection criteria, investing only in the most exceptional targets.

Wallace Tang, Chief Financial Officer of Blue Lake Capital, reviewed the latest performance of the Blue Lake USD Funds. Overall, the portfolios of Blue Lake’s USD Funds have been able to navigate through cycles, delivering strong and sustained returns.

In Blue Lake’s USD Fund I, II, and III, several portfolio companies have experienced years of rapid growth, establishing themselves as market leaders in their respective niches. These include Momenta, Jushuitan, Vevor, Zelos, Zaihui, Cloud Helios, and Zhenyun Technology. Notably, both Momenta and Jushuitan are currently in the process of IPOs in the U.S. and Hong Kong , respectively.

During its investment phase, Blue Lake’s USD Fund IV progresses steadily and maintains a balanced approach. The fund has already positioned several quality targets within the electric vehicle supply chain. Notably, TEEMO and Trugo Tech have emerged strongly after Blue Lake’s investment, achieving doubling growth in their businesses and securing follow-on financing in a short period.

China’s capital market is currently on the brink of recovery, with more value investment opportunities expected in 2025 and 2026. Blue Lake will align with this cycle, carefully managing the pace of investments and setting higher standards when choosing quality investing targets.

In its investment strategy, Blue Lake will continue to focus on advanced manufacturing and enterprise digitization, particularly within the electric vehicle supply chain, where significant changes in industry have attracted numerous outstanding startups. Blue Lake will pay more attention and allocate more resources in post-investment management, empowering portfolio companies to enhance their operations and business growth, assisting them to achieve a dominant position in competition.

On July 15, Shanghai Watson Rally Automotive Technology Co., Ltd. (hereinafter referred to as “Watson Rally”) announced the completion of tens of millions of Pre-A round of financing. The round was led by Blue Lake Capital, with participation from Haibang Venture, Pudong Venture Investment, and continued investment from its existing shareholder Chentao Capital. Yuefeng Capital (悦丰资本) served as the sole financial advisor.

Since its inception, Watson Rally has garnered significant attention from the capital markets. The company has secured the backing of strategic industry investors, market-oriented specialist funds, and top-tier state-owned enterprises, amassing over 100 million in cumulative funding.

Established in 2022, Watson Rally has focused on developing its proprietary electro-mechanical braking (EMB) system. Within just 18 months of its founding, the company has completed the design and prototype delivery of its full suite of EMB products. Watson Rally has been engaging in project collaborations with leading industry clients, continuously delivering and iterating on its products. In March this year, the company successfully completed winter calibration testing for multiple vehicle models equipped with its EMB technology. Additionally, the company has completed construction of its EPB production line in Pinghu, Jiaxing, and has initiated volume production and deliveries.

The proceeds from this round of funding will primarily support the development and delivery of EMB products, the volume production of its EPB offerings, as well as the development of its brake-by-wire control systems.

Founder Cai Xudong remarked, “We are grateful for the recognition and support from both new and existing shareholders. Watson Rally will continue to uphold our innovative spirit in product development, crafting competitive offerings constantly. At the same time, we will steadfastly maintain our rigorous and pragmatic approach to quality control, delivering high-quality, highly reliable solutions for our customers. Together with our clients, shareholders, suppliers, and industry partners, we will create shared value through reciprocal collaboration.”

Ray Hu, Blue Lake Capital’s Founder and Managing Partner commented, “We have long been observing the technology transformations within the new energy vehicle industry. EMB is a definitive next-generation brake-by-wire solution, and Watson Rally is a truly rare team in this arena, having already made impressive progress in both R&D and commercialization in a short period of time. In every exchange with the founders and the team, we have been deeply impressed by the company’s focus and execution capabilities. Blue Lake Capital is thrilled to embark on this journey alongside such an exceptional entrepreneurial team. We look forward to Watson Rally maintaining its first-mover advantage and leading the industry’s transformation.”

Blue Lake Capital, an investment firm focused on intelligent manufacturing and industrial digitalization, is highly attuned to the vast growth potential within the new energy vehicle industry supply chain. Blue Lake Capital has been actively investing in the new energy vehicle and autonomous driving supply chain in recent years. Among their invested companies, Momenta, Zelos, itimotor, and Trugotech have all achieved rapid business growth and secured follow-on funding.

Jushuitan is officially a Meta Business Partner

On April 22, Jushuitan’s Thailand company officially announced in Bangkok that Jushuitan has become a business partner of Meta. This milestone marks an important step for Jushuitan in providing social e-commerce solutions.

PICTURE | Jushuitan

Jushuitan’s partnership with Meta will enable merchants to leverage innovative social e-commerce tools for more efficient live-streaming sales and chat-based order placements. Anchored by Jushuitan’s global SaaS ERP platform, the integrated solution focuses on enhancing users’ social media shopping experience. By seamlessly connecting with local logistics and banking systems, Jushuitan delivers a comprehensive social commerce ecosystem.

As a Meta business partner, Jushuitan will gain access to more resources to accelerate product development and optimization. This strategic alliance will also enable Jushuitan to expand the market reach of its services. The company plans to roll out new features and offerings in the coming months to better serve its growing user base.

Zelos Awarded First-Ever License for Autonomous Logistics Vehicle in Singapore

Recently, Zelos has successfully passed CETRAN’s autonomous driving test program in Singapore, and was awarded the first-ever license for autonomous logistics vehicle in the country by the Land Transport Authority (LTA).

This milestone allows Zelos’ autonomous vehicles to operate on designated public roads in Singapore, marking a significant breakthrough for the company’s expansion into overseas markets. It also paves the way for domestic autonomous driving products to be deployed globally.

In October last year, Zelos signed a memorandum of understanding with NTUC FairPrice (also known as “GLS”) in Singapore, to collaborate on the nation’s first high-level autonomous urban delivery project.

The project is divided into three phases: feasibility testing in a multi-story logistics warehouse environment, actual operational phase for warehouse freight, and direct logistics transshipment between distribution centers.

PICTURE | Zelos

During this period, Zelos joined the working group of the Singapore Standards Council, participating in the revision of the local TR-68 autonomous driving specification technical standards. The company has been collaborating with relevant local authorities to determine the testing requirements for autonomous logistics vehicles to operate on public roads, filling the regulatory gap in Singapore.

Currently, Zelos’ collaboration project with GLS has entered the phase of direct freight logistics transshipment between distribution centers.

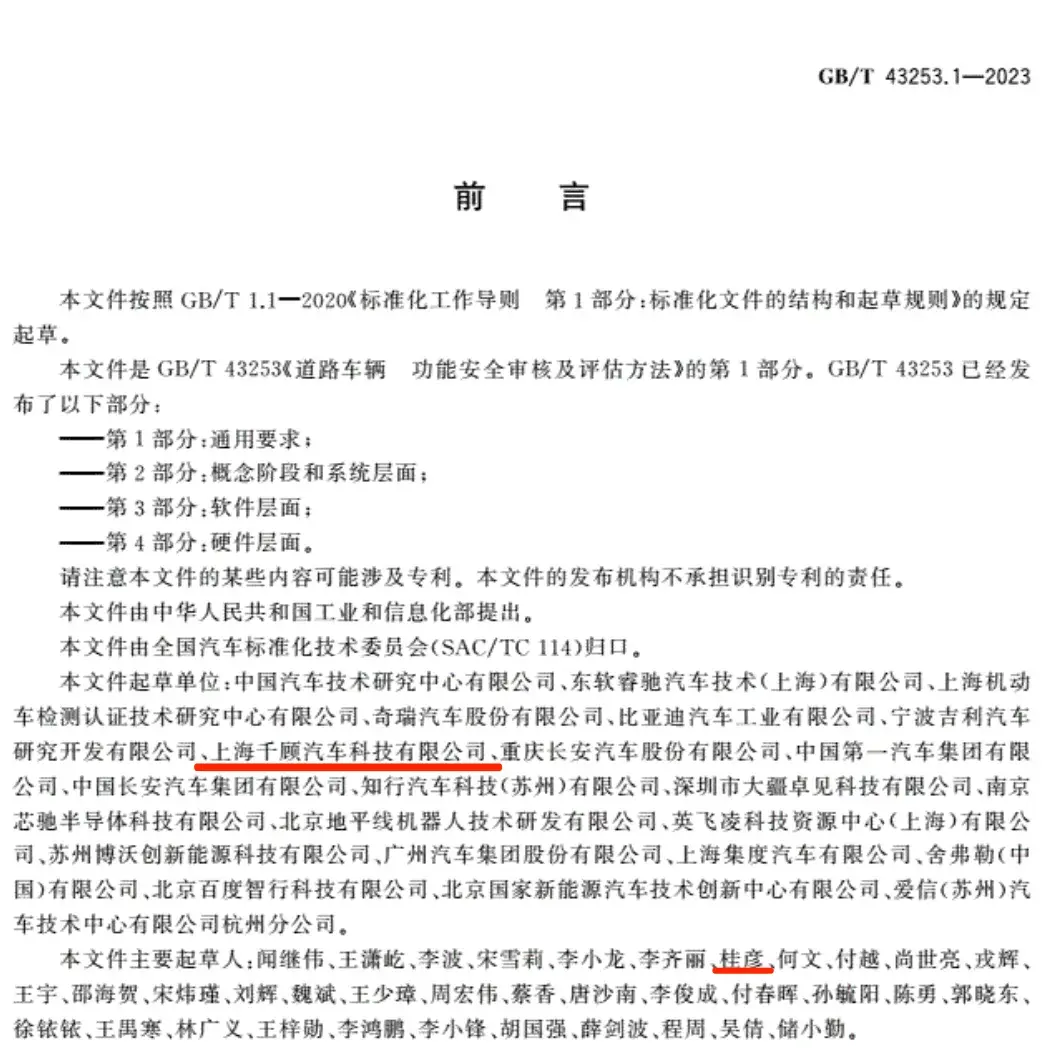

Trugotech Participates in Drafting National Standards

Recently, the Ministry of Industry and Information Technology (MIIT) released the National Standard “Road Vehicles – Functional Safety Audit and Assessment Method – Part 1: General Requirements” (道路车辆功能安全审核及评估方法第1部分:通用要求) (abbreviated as “GB/T 43253-2023”).

Trugotech’s representative Gui Yan served as one of the main drafters of the standard. He contributed Trugotech’s years of experience in vehicle functional safety and key technology in automotive components, playing a role in promoting the standardization and development of new energy and intelligent vehicles.

PICTURE | Trugotech

Trugotech has been deeply engaged in the research and industrialization of main components of the chassis for new energy and intelligent vehicles for many years. Drawing on its extensive experience in large-scale independent research and production, the company has contributed practical experience covering the entire lifecycle of chassis-by-wire system and products, including system design, product development, functional safety testing, system integration testing, vehicle testing and verification.

Trugotech strictly complies with the relevant standards and requirements of “GB/T 43253-2023” to ensure the safety and reliability of its chassis-by-wire products. This provides maximum protection and safety for drivers and passengers, earning the trust and recognition of numerous OEM customers.

Cospowers announces Ultra-Large Capacity Energy Storage Cell Solution

On June 13, Cospowers announced its super-large capacity energy storage cell solution – the 720Ah Tianchi series at 17th (2024) International Photovoltaic Power Generation and Smart Energy Conference and Exhibition. The series adopts third-generation high-speed stacking technology. The cell has zero attenuation for three years, , opening up a leap for a single unit of 2.3 kWh, enabling the company to advance into the long duration energy storage market.

PICTURE | Cospowers

Meanwhile, Cospowers has also brought a transformative product of power storage: EnerGalactic-6700 liquid-cooled battery compartment. This product is equipped with the 720Ah ultra-large capacity Tianchi series battery developed by the full stack of Cospowers, delivering over 15% more capacity than previous 5 MWh offerings.

Besides, Cospowers has unveiled a new line of industrial and commercial energy storage products, including the PowerEco-115kW/250kWh all-in-one sodium-ion battery. Featuring Cospowers’ proprietary 210Ah sodium-ion battery, this solution boasts an energy density exceeding 135 Wh/kg and cycle count of over 2,000 cycles, enabled by its advanced stacking technology.

Cospowers unveiled its latest technologies, products, and fully in-house developed solutions in the conference, earning widespread recognition from customers.

LINGXING ERP Retains Top Market Share in Cross-border E-commerce ERP

According to the “2024 China Cross-border E-commerce Software Service Industry Report” recently released by iResearch, the top brands in the cross-border e-commerce ERP market, led by Amazon, have demonstrated significant market dominance. Within this segment, LINGXING ERP maintains the leading market share among cross-border e-commerce ERPs focused on platforms like Amazon.

PICTURE | LINGXING ERP

In addition to Amazon, LINGXING ERP has integrated and connected with over 20 major global e-commerce platforms, including Walmart, TikTok, Temu, and more.

As the cross-border industries enter a new phase of development in 2024, LINGXING has also experienced high-speed growth, with YoY revenues increased 74% in 2024.

Moka Introduces “People Efficiency Management Solution”

On June 19, Moka co-founder and CEO Li Guoxing formally presented the “Moka People Efficiency Management Solution” at the Moka Ascend 2024 product launch event.

PICTURE | Moka

The “Moka People Efficiency Management Solution” empowers enterprises to better control costs and boost productivity for healthy development. It provides organizations with a clearer, more comprehensive understanding of their human resource operations, enabling continuous value creation throughout the process.

Moka’s CTO and partner Liu Hongze shares the company’s technological innovations and practical application of AI. AI-native concept is deeply integrated into every facet of the business, Moka Eva has not only upgraded from intelligent interviews to intelligent recruitment solutions, but also empowered a -new feature called “SmartPractice”, integrates global best practices from multiple countries and regions, providing intelligent support for recruitment activities worldwide, further refining the recruitment process.

TEEMO Launches Intelligent Skateboard Chassis

As an industry leader focused on developing universal and intelligent skateboard chassis, TEEMO has unveiled a high-performance intelligent skateboard chassis called AutoBots-W2.

PICTURE | TEEMO

The AutoBots-W2 is an integrated assembly component that highly integrates mechanics, electronic control, intelligent domain control, active and passive safety, and autonomous driving. It serves as an extremely versatile platform that is highly useful for designers focused on creating low-speed autonomous scenario applications. Such design allows scenario design companies to save on development cycles and validation expenses. This enables them to quickly bring to market products that can effectively address user requirements. The new AutoBots-W2 intelligent skateboard chassis provides developers with a fully open space to freely design the upper-level equipment. This embodies the concept of a large open-plan layout with utilization rates approaching 100%, enabling developers’ maximum flexibility. Scenario designers only need to design the upper-level body in accordance with the user’s scenario requirements. This fully realizes the inherent spatial freedom advantage of a skateboard chassis architecture.

By matching the varying wheelbase sizes and load capacities of the AutoBots-W2 and AutoBots-W7 models, TEEMO can expand the application of their intelligent skateboard chassis solutions to a wider range of scenarios, such as autonomous logistics, unmanned patrol, smart agriculture, and beyond.

Source: IPO Zaozhidao; Author: Stone Jin

According to IPO Zaozhidao, on 17 June 2024, the Department of International Cooperation of the China Securities Regulatory Commission issued a Notice of Overseas Issuance and Listing Filing of Momenta Global Limited (梦腾智驾环球有限公司), a portfolio company of Blue Lake Capital.

In other words, Momenta has been approved for an IPO in the US – according to the filing notice, Momenta plans to issue no more than 63,352,856 ordinary shares for listing on the NASDAQ Stock Exchange or the New York Stock Exchange in the US.

Established in 2016, Momenta has developed a data-driven “flywheel” technology platform that powers its dual-pronged product strategy – for production-ready autonomous driving and MSD for fully self-driving capabilities, which provides autonomous driving solutions at varying levels of automation. This enables the efficient and accelerated scalable deployment of self-driving capabilities, empowering the realization of a smarter, safer and more convenient transportation future.

Specifically, MSD (Momenta Self-Driving) is a fully autonomous driving solution designed for L4 and above applications, suitable for use cases such as taxis and private cars; while Mpilot is a highly automated driving solution, positioned as a production-ready, fully-integrated autonomous driving stack for factory-installed applications in private cars. Core products include Mpilot X and other end-to-end, continuous highly automated driving solutions covering a wide range of scenarios, such as highways/urban expressways, parking, and urban areas.

Momenta CEO Cao Xudong recently outlined the company’s dual-pronged strategic approach – a “flywheel” coupled with a two-pronged execution plan. One flywheel refers to the data-driven AI flywheel. One prong is mass-production-ready L2 level intelligent driving solution, scaling deployments to hundreds of thousands, even millions of vehicles in collaboration with leading automakers. This will generate massive data streams to train autonomous driving algorithms and tackle long-tail challenges in reaching L4 full self-driving. The other prong is their L4 full autonomy solution, continuously providing a technology pipeline to rapidly advance the capabilities of their mass-produced intelligent driving products.

In Cao Xudong’s view, this mutually reinforcing two-pronged approach allows the data from their production-ready L2 vehicles to train the algorithms for their L4 autonomy solution, while the L4 capabilities in turn elevate the technology ceiling and progression of the L2 offering. By seamlessly integrating the technology stacks and data pipelines between their production intelligent driving (Mpilot) and full autonomous driving (MSD) solutions, Momenta aims to ultimately achieve scale in true self-driving capabilities.

Blue Lake Capital was an early investor in Momenta since its establishment in 2016 and led its angel round funding. Since its inception, Momenta has received investments from well-known institutions and automakers such as Blue Lake Capital, ZhenFund, Sinovation Ventures, Shunwei Capital, NIO Capital, Daimler, JIYUAN CAPITAL, Cathay Capital, Tencent, China Merchants Innovation Investment (招商局创投), Oriza Capital, CCB International, Temasek, Robert Bosch Venture Capital, SAIC, YF Capital, Mercedes-Benz Group China, General Motors and Toyota Motor, among others.

Notably, major automakers including SAIC, General Motors, Toyota Motor are not only investors in Momenta, but also its crucial customers. Meanwhile, Momenta’s collaboration with Mercedes-Benz is poised to come to fruition as early as next year.

As Cao Xudong revealed, Momenta has established production partnerships with half of the world’s top ten automotive groups, with business operations spanning China as well as international markets in Germany, Japan, and the United States, etc.

Linden Chassistech (上海琳顿汽车底盘件制造有限公司), an automotive chassis component manufacturer and R&D company, recently announced the completion of a 30 million RMB Pre-Series A funding. The investment was led by Blue Lake Capital, with participation from Gaorong Ventures (高榕创投), eGarden Ventures (毅园资本), and Jun Zhiyan (骏之彦). The funds raised in this round will be primarily utilized to accelerate the industrialization of new products.

Established in July 2023, Linden Chassistech specializes in the design, R&D, and manufacturing of automotive shock absorbers in China, along with finished vehicle matching and tuning. The company was founded by industry experts in the Chinese automotive shock absorber sector, with Dr. Ye Guohong (叶国弘), Co-founder and CEO, being a pioneer in introducing modern shock absorber technology to China and having previously served as the president of ZF China.

Linden is committed to meeting the rigorous safety and comfort requirements of new energy vehicles in the era of electric cars through the development of semi-active and active shock absorbers, along with other critical components. By utilizing fully self-developed automated production lines, Linden realizes high-quality lean manufacturing in line with the principles of Industry 4.0.

Linden’s electronically controlled shock absorber products are automotive chassis components leveraging electronic control technology. These components have the capability to instantly perceive and respond to the vehicle’s performance, traffic conditions, and driver inputs, thereby adjusting the vehicle’s damping effect.

As automotive electrification and intelligent technologies continue to accelerate, there is an increasing demand for personalized and intelligent chassis solutions. The demand for electronically controlled shock absorbers has seen significant growth in the past few years. As the trend of domestic production of vehicle components continues, there is a market potential worth billions of dollars within the domestic market alone.

Linden is currently developing two assembly products: the external single-valve (SV) and the external dual-valve (DV) electronically controlled shock absorber. These products feature Linden’s next-generation electromagnetic valves, which excel in performance data and meet the design requirements for forward development. They are at the forefront of the industry in terms of control precision and product consistency.

According to the Linden team’s projections, starting from 2025, DV electronically controlled shock absorbers will gradually become more prevalent in the Chinese mid-to-high-end vehicle segment. DV systems outperform SV systems, as they have the ability to independently control compression and rebound damping. This allows for more precise damping characteristics, ultimately enhancing the sophistication of wire-controlled chassis control strategies and enabling faster chassis tuning processes.

The DV technology elevates the ride comfort and delivers a more responsive driving experience, particularly for vehicles with increased sprung mass, such as new energy vehicles. Its application marks a significant milestone in the automotive industry’s progression from semi-active to fully active suspension systems, opening up an entirely new avenue in the automotive sector.

Linden’s in-house automation team is currently designing and developing the production lines for electromagnetic valves and shock absorbers. It is projected that both production lines will become operational by the end of June 2024. The first phase of Linden’s fully automated production line is expected to achieve an annual capacity of one million electronically controlled shock absorbers and electromagnetic valves.

The increasing penetration of electric vehicles has raised the requirements for vehicle chassis. Electronically controlled shock absorbers that offer rapid response capabilities and real-time adjustment of driving modes based on traffic conditions have become a crucial necessity for automakers.

Following this round of financing, Linden anticipates accelerating the industrialization of new products and expediting the capacity expansion of shock absorber assembly and electromagnetic valve production lines. The goal is to become a leading domestic and globally recognized player in the automotive shock absorber industry.

“We maintain an enduringly positive outlook on the dynamic growth of the new energy vehicle industry, both within China and across the globe,” said Ray Hu, Founder and Managing Partner of Blue Lake Capital. “We are also thrilled to invest in a truly exceptional startup like Linden. With the founding team’s extensive industry experience and excellent product design and manufacturing capabilities, we believe that the company is poised to emerge as another outstanding player in the automotive core components sector.”

JST Group Corporation Limited (“Jushuitan” or the “company”), a portfolio company of Blue Lake Capital, has updated its IPO prospectus on March 21, 2024, as it progresses with its listing process on the Main Board of the Hong Kong Stock Exchange. CICC and J.P. Morgan are acting as the joint sponsors.

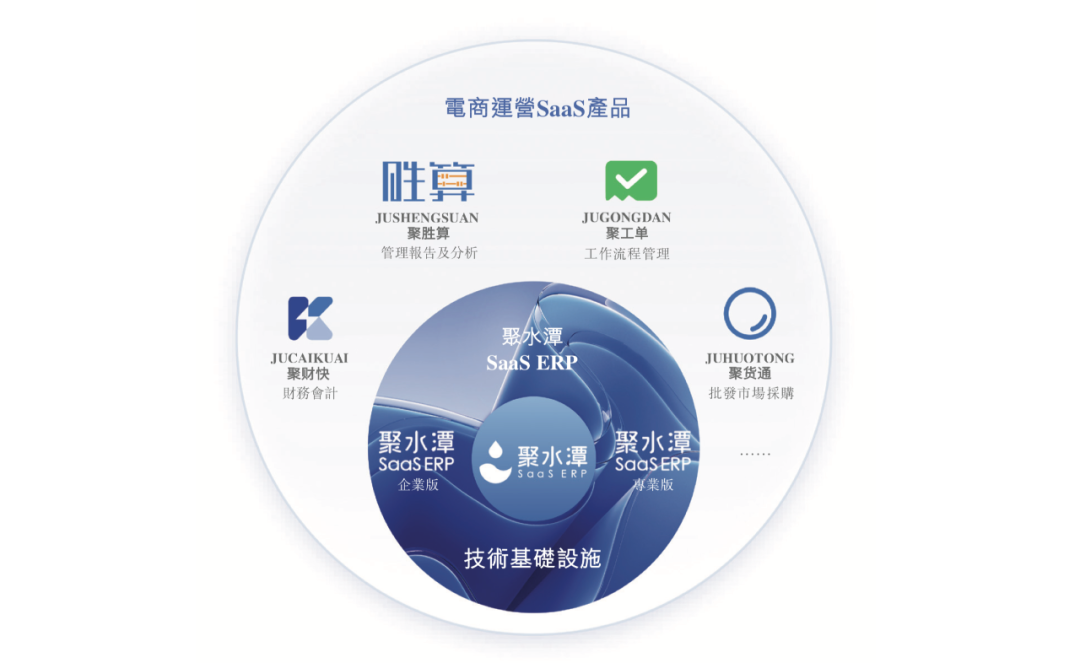

Established in 2014, Jushuitan has developed a comprehensive set of cloud-based e-commerce SaaS products, enabling businesses to seamlessly upgrade capabilities, improve performance, grow their cross-platform operations, and reduce deployment and operational costs.

Jushuitan is China’s largest e-commerce SaaS ERP provider in terms of relevant revenue in 2023, with a market share increasing from 20.7% in 2022 to 23.2%, according to CIC. In China’s e-commerce operation SaaS market, the company also ranks first based on the total SaaS revenue in 2023.

Specifically, Jushuitan ERP is the company’s cornerstone SaaS product, which serves and fulfills the critical needs of merchant customers in handling e-commerce order-related operations on e-commerce platforms. Merchants can integrate, synchronize, and coordinate all their stores, orders, products, inventory, and other operating or financial data across multiple platforms through Jushuitan ERP, enjoying a streamlined cross-platform business experience. Currently, the Jushuitan ERP offers key functionalities such as Order Management System (OMS), Warehousing Management System (WMS), Procurement Management System (PMS) and Distribution Management System (DMS), among others. According to the report by CIC, Jushuitan ERP has emerged as the most popular e-commerce SaaS ERP brand among Chinese merchants.

In 2023, Jushuitan ERP well managed the processing of approximately 65 million orders per day, with a peak daily order volume reaching 233 million, being acknowledged as an e-commerce SaaS ERP with the highest order processing efficiency in China. According to CIC, Jushuitan ERP is also one of the fastest iterating e-commerce SaaS ERP products in China in terms of the number of iterations. From 2021 to 2023, Jushuitan ERP maintained an average response time of less than 50 milliseconds and an uptime of more than 99.5%.

Building upon its ERP foundation, Jushuitan has further expanded product and service offerings to encompass other e-commerce operation SaaS products. As of December 31, 2023, the company has introduced four additional e-commerce operation SaaS products (excluding ERP). Jushuitan’s suite of SaaS tools caters to diverse needs of e-commerce participants, providing capabilities such as financial accounting, management reporting and analytics, workflow management, and wholesale market procurement.

In 2023, Jushuitan served 62,200 SaaS customers across various categories, as compared to an industry average of less than 20,000 customers in 2023.

Jushuitan has demonstrated notable performance in two sets of data that reflect the excellence of a SaaS company. From 2021 to 2023, Jushuitan achieved an LTV/CAC ratio over 6x. This ratio measures the relationship between customer lifetime value and customer acquisition cost, with the industry average being approximately 3x. Meanwhile, Jushuitan‘s net dollar retention rate in 2023 stood at 114%.

Furthermore, in the years 2021 to 2023, customers who purchased two or more Jushuitan products contributed 27.6%, 30.6% and 33.0% respectively of its total SaaS revenue for each respective year.

In terms of financial data, Jushuitan‘s revenue for the years 2021, 2022, and 2023 were RMB433 million, RMB523 million, and RMB697 million, respectively, with a compound annual growth rate of 26.8%. During the same period, the company’s gross profit margins were 50.5%, 52.3%, and 62.3%, showing a year-on-year increasing trend.

Notably, Jushuitan‘s revenue in 2023 exhibited a higher year-on-year growth rate compared to 2022, accompanied by a significant increase of 10 percentage points in gross profit margin. The improvement in gross profit margin is attributed primarily to economies of scale and an increasing proportion of recurring customers. Additionally, Jushuitan‘s adjusted net losses narrowed by 45.8% year-on-year, and the adjusted net loss rate decreased sharply from 72.4% in 2022 to 29.4%.

In this regard, Jushuitan has the potential to soon become a Chinese SaaS company with annual revenue surpassing US$100 million and positive adjusted net profit. In the U.S. SaaS industry, reaching US$100 million in revenue is often seen as a threshold for scale.

As of December 31, 2023, Jushuitan held cash and cash equivalents amounting to RMB897 million, more than doubling from RMB427 million as of December 31, 2022. In 2023, Jushuitan generated net cash inflow from operating activities of RMB210 million, representing a year-on-year growth of 165.8%.

Since its establishment, Jushuitan has received investments from renowned institutions such as Ameba Capital, Welight Capital, Vision Plus Capital, Blue Lake Capital, HongShan, Goldman Sachs, and CICC Capital.

Haitao Wei, Partner of Blue Lake Capital, recently shared his insights with Asian Venture Capital Journal (AVCJ), highlighting investment opportunities in autonomous driving and Blue Lake’ s perspective on commercialization of L4 autonomous vehicles.

Read the full article here:

While many industry peers prioritise more proven but less advanced technologies to maximise customer appeal, Zelos will use its USD 100m Series A to roll out vehicles aimed at specific landing scenarios

Level-four (L4) autonomous driving technology, where vehicles are fully self-driving in certain situations, but the option of human override remains, has attracted considerable private investment in China. WeRide, WM Motor, Haomo AI, and Zhongmu Tech raised single rounds of USD 1bn in 2021 and 2022, largely on their bold ambitions for L4 robotaxis.

Now, conservatism reigns. Large tickets are no longer readily available, and start-ups are focused on near-term monetisation. The road leads in two directions: to L4 applications in industrial scenarios rather than mass-market consumers, and to L2 or partial autonomy solutions. Both offer the prospect of a quicker journey from prototype to pilot project to paying customers.

Zelos Technology, which recently received a USD 100m Series A round led by Meituan, is a case in point. Robotaxis and long-haul trucks are part of the vision, but low-speed L4-enabled freight vehicles are the company’s strategic priority. This category strikes the right balance between breadth of use – vehicles specifically designed for ports and warehouses were seen as too narrow – and commercial appeal.

“Is there market demand, a willingness to pay, and a potential route to profitability? How can we achieve commercialisation at scale? If we cannot answer these questions properly, we should not accept the risk,” said Yunjian Shi, head of financing at Zelos.

The company released its fifth-generation product, the Zelos Z5, last May. The vehicle has a capacity of 5 cubic meters, up from 1.7 cbm for the Z1, and a range of 140 kilometres. It is intended for long distance transportation between central warehouses, transfer depots, distribution centres, and stores – up a level from last-mile delivery and garbage collection in terms of technology needs and price point.

Over 90% of customers are small businesses, typically franchisors or distributors for leading logistics and retail brands like YTO Express, SF Express, CR Pharmaceutical, and Mengniu Dairy. Larger players want customised vehicles. Zelos offers standardisation, Shi explained, but the company tailored its offering based on customer feedback – for example, introducing larger load spaces for greater cost efficiency.

Blue Lake Capital estimates that China’s urban delivery market was worth CNY 1.5trn (USD 209bn) in 2023 with 20m vehicles on the roads. High operating costs and recruitment challenges are the major pain points in urban logistics, according to Haitao Wei, a partner at Blue Lake. Zelos claims to address both.

“Creating a self-driving vehicle enables greater productivity at a reasonable cost – we believe this will happen in China,” Wei added. “When assessing investment opportunities, we don’t merely focus on the technology; we also consider the commercial possibilities at the product level, driven by the transformative power of technology.”

The VC firm’s debut autonomous driving investment in China was a Series Angel round for Momenta, a provider of L2 and L4 solutions, in 2016. The company became one of China’s first unicorns in the space, closing a Series C of over USD 1bn in 2021. Blue Lake has also backed smart camera supplier Sensing, testing services provider ITImotor, chassis developer Trugotech, and sensor manufacturer Trensor.

It helped build Zelos from the ground up in 2021 by incubating a business idea developed in conjunction with Qi Kong, formerly chief scientist and head of autonomous driving at JD.com. Blue Lake re-upped in the Series A, which also featured Baidu Ventures, Unicorn Capital Partners, Xianting Private Equity Fund Management, Seekdource Investment Management, and C&D Emerging Industry Equity Investment.

The venture capital firm participated through its US dollar and renminbi funds, each in its third vintage. Co-investment was offered to LPs, including Unicorn, in both currencies.

Zelos was originally a pure software developer, but now hardware specialists make up about half of the company’s 180-strong R&D team. “To achieve stable commercialisation of L4 technology, focusing solely on algorithms may not suffice; hardware development is also essential,” Shi observed. “Additionally, with a longer value chain, we can generate more profit.”

The hardware element is not straightforward. When Zelos sought to expand capacity to 5 cbm for the Z5, chassis suppliers rejected the idea. The company responded by building its own chassis. It now has vehicles in operation across 50 Chinese cities and has also entered Singapore. Sales of the Z5 reached 1,000 units in December alone. Qi has predicted a tenfold year-on-year increase in sales in 2024.

Zelos is not China’s only provider of L4 urban delivery vehicles – Rino Ai’s Baixiniu, Haomo.ai’s HDeliver 3.0, WeRide’s Robovan, and Neolix’s X3 Plus are all available, with some differentiation in terms of landing scenario. Shi said he wouldn’t be surprised if a handful of leading players end up accounting for the majority of market share.

Expansion into passenger vehicles will only be considered once the current product offering has achieved stable implementation. Risk factors include failing to maintain technology and product advantages – and thereby failing to satisfy customer demand – before entering mass production.

Blue Lake’s Wei observed that Zelos has already navigated the riskiest stage, going from zero to one. Product safety is a key concern on the road to commercialisation – but commercialisation must happen sooner rather than later.

“The competition barrier is formidable regarding commercial landing scenarios in unconfined areas. For intelligent products, the faster companies proceed with commercialisation, the more real-world data they collect for training and the better customer experiences they can provide,” Wei said. “Achieving seamless integration of software and hardware typically requires at least 2-3 years.”

© Mergermarket Limited, 10 Queen Street Place, London EC4R 1BE – Company registration number 03879547

Original article link:https://mergermarket.ionanalytics.com/content/1003765725

Zelos, a global leader in R&D and application of urban distribution autonomous driving products invested by Blue Lake Capital, has recently announced the completion of its Series A financing of nearly US$100 million led by Meituan, with Baidu Venture, Unicorn, Xianting Fund and Seekdource participating. Meanwhile, existing shareholders Blue Lake Capital and C&D Emerging Industry Equity Investment make additional investments, and Lighthouse Capital serves as the exclusive financial advisor. Upon the completion of financing, Zelos will further boost technology R&D and creation of supply chain, accelerate model implementation and talent team building.Amid the continuous development of intelligent and electrification technologies, the mobility sector is actively embracing the industrial wave. Passenger vehicles are widely adopting new energy and smart driving approach, and at the same time, there is ample room for industrial upgrading in commercial vehicles, logistics and other sectors. Since 2019, the penetration rate of new energy commercial vehicles has increased from 1% to 11%, triggering the exploration of application of L4 smart driving in commercial vehicles.

In the logistics industry, urban distribution is the logistics scenario closest to end customers. Current statistics show that the total urban distribution market size has reached RMB1.5 trillion, and the number of transportation vehicles has reached 20 million. Additionally, as the scenarios of the urban environment are highly open, urban distribution scenarios become more complex than those in ports, mining areas, trunk lines and other environment. The development and mass production of new energy L4 smart commercial vehicles under urban distribution scenarios are prone to higher technical barriers. Thus, at the recent fourth meeting of the Central Financial and Economic Affairs Commission, the reform of the comprehensive transportation system was highlighted with the aim of forming a unified, efficient, competitive and orderly logistics market, and encouraging the development of new model of logistics integrating platform economy, low-altitude economy, autonomous driving, etc. Meanwhile, a number of policies have been successively issued, including the “Notice on Carrying out Pilot Work on the Access and Road Access of Intelligent Connected Vehicles”, which gradually create favorable conditions for the implementation of L4 commercialization in the urban distribution scenario. The cost of key components such as lidar and lithium battery packs has also reduced, thereby reducing the mass production cost of new energy L4 commercial vehicles.

As a global leader in R&D and application of urban distribution autonomous driving products, Zelos integrates technology R&D, product design and commercial application, and has successfully developed L4 full-stack autonomous driving technology used in mature and large-scale commercial sector. Zelos has considerable expertise in underlying systematization, including L4 algorithm R&D, product development, vehicle delivery, sales and operation and maintenance, and has internally developed all software and hardware modules, facilitating the building of three major technology platforms: intelligent platform, vehicle platform, and electrification platform.

In 2023, Zelos launched the world’s first L4 urban distribution mass-produced product, Zelos Z5 series, which keeps the three indicators at the highest level in the industry: loading space, operating mileage and load weight, covering a wide range of urban business scenarios such as express delivery, on-site logistics and fresh food delivery. By integrating new energy and intelligent driving, Zelos products can significantly reduce the energy and labor costs of commercial vehicles, helping customers to reduce costs and raise efficiency by over 50%.

Leveraging its robust vehicle design capabilities, Zelos Z5 series iterated quickly and finalized the mass production of the world’s original 5m3 flagship model within one year, and developed different vehicle models such as standard, multi-grid and cold chain to cater for different scenarios such as logistics, express delivery, and retail. Over the past year, Zelos has upgraded five models, and its key indicators such as single-vehicle carrying capacity and average car speed far exceed the level of peers.

Zelos has established an L4 autonomous driving R&D team with expertise in both technology development and commercialization, which is not commonly found in the industry. The team has developed full-stack L4 autonomous driving technology, as well as core algorithms and software and hardware modules, including map and positioning, perception and decision-making, computing platform, operating system, simulation system, vehicle execution, chassis control and other key links. It also promotes algorithm iteration through real-time driving data to create the data flywheel characterized by “driving data-algorithm iteration-feedback verification-product iteration” in order to continuously improve L4 algorithm capabilities.

Currently, Zelos urban distribution autonomous vehicles are traveling in over 50 cities. L4 series has been running with the cumulative operating mileage exceeding 2 million kilometers. Taking the advantages of coping with complex road conditions such as rain and snow, complex intersections, elevated tunnels, etc., its core indicators are leading in the industry. Zelos has also planned and established a vehicle production system that meets market demand.

Wei Haitao, partner of Blue Lake Capital said, “I am delighted to work with Zelos to explore L4 autonomous driving products and accompany Zelos to build a world-class autonomous driving technology team. Blue Lake Capital is firmly optimistic about autonomous driving in the future. I believe that Zelos will be able to bring the industrialization of L4 autonomous driving to new heights.”

As the first-ever L4 smart urban distribution vehicle company in the industry that can secure positive gross profit by adopting the “turnkey car sales” approach, Zelos will further enhance the technology R&D and products for urban distribution scenarios ranging within 180 km, bringing more powerful autonomous smart vehicle products to the urban distribution market. In the near future, Zelos will successively explore and study smart logistics products supporting longer range and more scenarios, keep on promoting the optimization of efficiency of the logistics industry, and help create a more convenient, smarter, and greener logistics ecosystem.

Blue Lake Capital has been deeply developing the autonomous driving and new energy vehicle industry chain in recent years. In June 2021, it made an exclusive investment in Zelos Angel Round, and has continued to make several additional investments in subsequent rounds.

The 2023 Blue Lake Capital Annual General Meeting (AGM) was successfully held in Shanghai on 11 September 2023. This event brought together more than a hundred investors, entrepreneurs and experts in the industry around the globe, with the spotlight turned on the development of advanced manufacturing, enterprise service software and other fields, allowing in-depth discussions on industry development prospects and investment opportunities.

Ray Hu, Founder & Managing Partner of Blue Lake Capital, delivered an opening speech at the start of the meeting, in which he extended his cordial welcome to investors who travelled long distances for the event. In 2023, countless investment opportunities are hidden behind the constant fluctuations and changes in the capital market, and Blue Lake Capital actively embraces technology and industry development trends, with an aim to bring long-term value and returns to investors.

At this meeting, the distinguished guest speaker Chen Li, chief economist of Soochow Securities, was invited to share insights into the latest developments and prospects of China’s macroeconomics. He analyzed the current macroeconomic situation from the perspectives of domestic demand, external demand, capital flow, investment environment and more, providing investors with important insights into China’s economic trends.

The meeting also invited Huang Yiquan, CEO of Hand Enterprise (300170) to discuss with Ray Hu the current situation and future of China’s software industry. Huang Yiquan believed that enterprises’ demand for SaaS software is mainly driven by two major factors: first, the expansion of enterprises in the international market sparks demand for collaborative operation of global supply chain systems; second, enterprises actively promote digital transformation and seek various solutions to improve efficiency, reduce costs and improve business procedures.

Regarding the future development direction of SaaS companies, Huang Yiquan said SaaS enterprises should focus on specific fields, scenarios or industries as China’s software market matures, in order to provide customers with thought-provoking products and meet the diverse needs of the market. Whether it is personalized requirements or standardized products, they are expected to find their places in the Chinese software market.

Ray Hu indicated that the wave of digitalization has given rise to opportunities in the information technology industry, especially in the industrial field, where the trend of digitalization has become increasingly apparent, in turn bringing development opportunities to SaaS companies. Although there are changes in valuation and investment sentiment of the software industry recently, the rapid growth of the SaaS market demand continues. In addition, as the ChatGPT technology penetrates into various business operation scenarios, the SaaS industry has also been provided with new opportunities for its development.

In a panel discussion hosted by Haohui Chen, Partner of Blue Lake Capital, Liu Luyao, CFO of Jushuitan, Zhang Changzheng, CEO of Cloud Helios and Lu Chengtong, CEO of Thinking Data had a wonderful conversation on how to improve corporate operating efficiency and maintain healthy growth under the new environment as well as how to evaluate and embrace the changes brought about to the industry by AI.

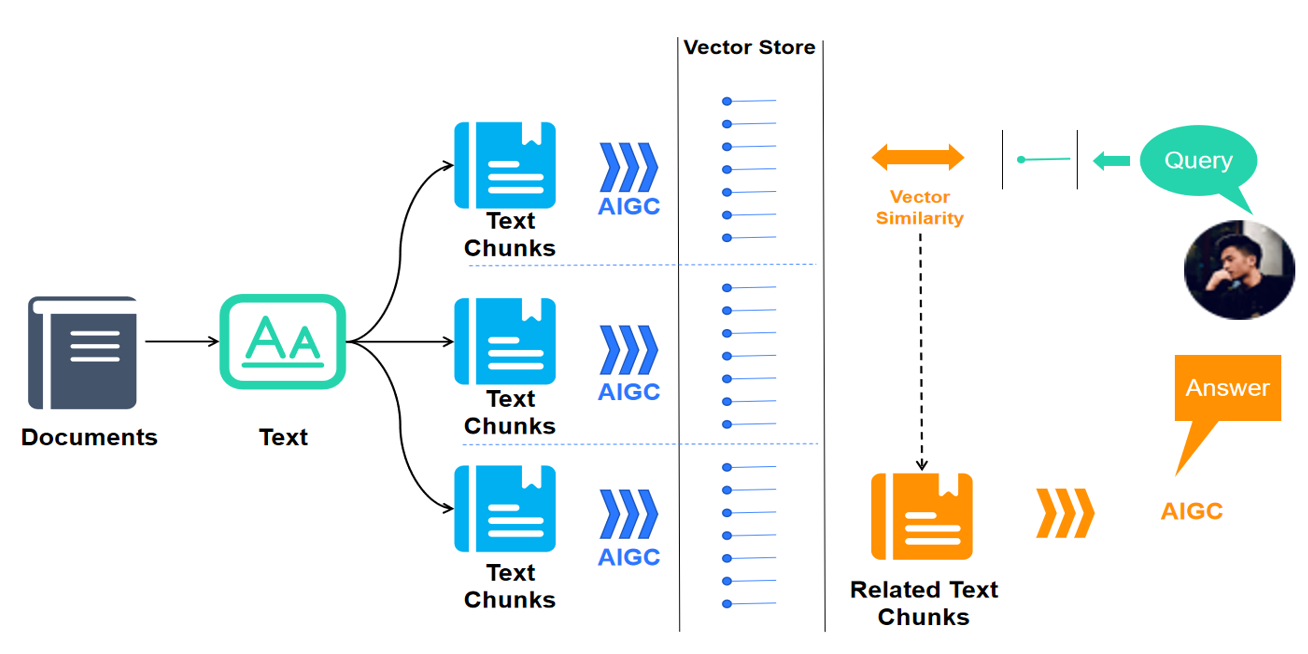

Assessing the impact of AI on business and products, Liu Luyao, CFO of Jushuitan indicated that AI is very helpful in improving the human resources efficiency of customer service teams in the ERP field. The company was already testing the use of AI and big data models such as ERNIE Bot and ChatGPT to share its customer service team’s workload, maintaining the size of the customer service team while achieving business growth.

Zhang Changzheng, CEO of Cloud Helios, pointed out that the company has made many attempts based on the technology of Open AI and continues to evaluate its effectiveness and commercialization. Among such attempts, the use of Open AI technology in financial audit scenarios can help customers improve audit efficiency by 50%.

Lu Chengtong, CEO of Thinking Data, indicated that Thinking Data has added capabilities of ChatGPT to its upcoming product version, which mainly provides applications in three aspects: 1) translation of international application versions; 2) AI-generated internal knowledge base system as customer service to answer questions raised by customers; 3) extract and directly generate data.

Subsequently, Haitao Wei, Partner of Blue Lake Capital, shared the current developments of China’s advanced manufacturing industry and the layout of Blue Lake Capital.

Opportunities constantly emerge amid the rapid and high-quality growth in the manufacturing industry, such as electric vehicles, lithium batteries, solar energy and more. Digital transformation is already taking place in industrial production, and there are extensive investment opportunities in smart manufacturing and digitalization.

Blue Lake Capital has been actively deploying industrial digitalization and intelligence since 2016. Taking electric vehicles and autonomous driving as examples, Blue Lake Capital has been seeking opportunities of digitalization along the industrial chain as well as upstream and downstream business. Currently, it has deployed in subdivided areas such as control, execution, and perception. Representative companies include: Momenta, Zelos, TruGo and more.

Subsequently, Ray Hu reviewed the investment portfolio and performance of the fund. Since the establishment of USD Fund I, Blue Lake Capital has adhered to its original intention of technology investment in the face of the ever-changing market, with a focus on the investment ideas of digital transformation and upgrading, serving as a lead investor in multiple projects.

The investment portfolio of the USD Funds I, II, and III had outstanding performance, and have invested in various industry-leading companies, such as Momenta, Zelos, Jushuitan, Cloud Helios, Thinking Data, Zhenyun Technology. These businesses have shown a trend of rapid growth and impressive investment returns.

In the new USD Fund IV, Blue Lake Capital focuses on industrial digitalization and continues to actively develop its layout into the rapidly developing autonomous driving and electric vehicle industries. It has successfully promoted a number of investment cases before the end of the fundraising period. In addition, in the face of market changes that varied from the fund’s expectations, Blue Lake Capital is also seeking more flexible and prudent ways to enhance the fund’s risk resilience.

In the afternoon, participants had a thorough experience of the products of two star companies, Momenta and Zelos. Zelos connected to the unmanned city vehicle distribution system at the scene, allowing participants to experience the unmanned vehicle commercial operation developed by Zelos in real time. Momenta specially set up a self-driving test ride session, in which participants were invited to get on the vehicle and experience the charm of self-driving, strengthening interaction and communication in the immersive activity.

This AGM has strengthened the close connection between investors, entrepreneurs and Blue Lake Capital. Looking ahead, Blue Lake Capital will continue to seize the development opportunities of industrial digitalization and explore more valuable opportunities in order to empower more technology companies in all aspects, injecting new impetus into further prosperous development of the industry.

4th July 2023 saw the opening of the Intelligent Driving Technology Congress 2023 in Jinqiao, Pudong. The event is held under the guidance of the Pudong New Area Government and the organising committee of the World Artificial Intelligence Conference, organised by the Science & Economic Committee of Pudong New Area, Shanghai and the Shanghai Jinqiao Economic & Technological Development Zone Administration Committee, and jointly co-organised by Golden Bridge Ltd (金桥股份) and SAE International, with an aim to adapt to the trend of digitalisation and industry innovation, thoroughly put into practice the national strategy to raise competitiveness in the transport sector, and actively promote the innovative development and demonstrative application of intelligent connected vehicles (ICVs).

At the conference, Blue Lake Capital and Golden Bridge Ltd signed a Letter of Intent on Ecosystem Building, according to which both parties will leverage their own resources to support the creation of a mobility ecosystem of the future in Jinqiao, jointly build a networking circle for the industry, foster its development, and explore building technology incubation and innovation service platforms, such as innovation centres for large firms and testing platforms for ICVs. The goal is to jointly nurture Jinqiao’s automotive ecosystem for the future and turn it into a world-class automotive industrial centre.

13 leading investment institutions, including HongShan, GGV Capital, Shenzhen Capital Group, Loyal Valley Capital, FTZ Fund, DHLT Investment and Oriental Fortune Capital, also signed agreements.

As the core powerhouse of Shanghai’s development of ICVs, Jinqiao in Pudong is committed to building a world-class automotive industrial centre and becoming an international front-runner in ICV development. The Jinqiao Future Mobility Industrial Park will be built around the automotive industry to provide solid backing for the development of ICVs, as a crucial foundation for building the industrial ecosystem, increasing the concentration, and expanding the circle.

The opening ceremony officially kickstarted the Jinqiao Future Mobility Industrial Park, which is comprised of the “twin parks”, namely the Office Park “Jinke” and the Office Park “Jinhai”, with a total area of around 360,000 square metres. A large number of key frontier industries, important investment institutions and ecosystem partners signed agreements to settle in the park, while ecosystem partnerships have been announced between Golden Bridge Ltd and 12 leading enterprises, including SAIC-GM, UAES, Bosch (China) Investment, Changan Automobile, China Mobile and BlackBerry.

Blue Lake Capital has a long-standing focus on advanced manufacturing. In recent years, with in-depth planning in areas such as autonomous driving and the NEV industry chain, it has invested in under-appreciated top runners of the industry, such as Momenta, Zelos, SENSING, and Trensor.

Armed with trusted partnerships, Blue Lake Capital will continue to seize the opportunities brought about by technology innovation, provide comprehensive services to help more intelligent manufacturers achieve solid development, actively build the industrial digitalisation ecosystem, and inject vitality into the industry in the future.

Source: Wechat official account IPOzaozhidao Author: Stone Jin

JST Group Corporation Limited (hereinafter referred to as “Jushuitan”) officially submitted an IPO application to the Hong Kong Stock Exchange on 19 June 2023 for listing on the main board. CICC and J.P. Morgan are joint sponsors.

Founded in 2014, Jushuitan has now developed a comprehensive suite of cloud-based e-commerce SaaS products that help merchants upgrade their business capabilities, improve performances and develop business across platforms seamlessly while reducing the costs for deployment and operation.

As of 31 December 2022, Jushuitan has connected its merchants to over 350 e-commerce platforms and more than 700 logistics and warehouse service providers across the globe, making it one of the providers with the most extensive e-commerce platform coverage in China’s e-commerce SaaS industry. Jushuitan have become the solution of choice in China’s e-commerce SaaS ERP, in terms of the number of merchants served across key Chinese e-commerce platforms.

In particular, Jushuitan ERP is the company’s core SaaS product, which serves and meets the key needs of merchant customers related to the processing of e-commerce orders on e-commerce platforms. Through Jushuitan ERP, merchants can integrate, synchronize and coordinate all their operational or financial data across platforms, and enjoy a seamless cross-platform business experience. The key functions currently provided by Jushuitan ERP include order management system (OMS), warehouse management system (WMS), procurement management system (PMS) and distribution management system (DMS). According to China Insights Consultancy (CIC), Jushuitan ERP has become the most popular e-commerce Saas ERP brand among Chinese merchants.

As China’s most efficient e-commerce SaaS ERP for processing orders, in 2022, Jushuitan ERP processed approximately 50 million orders daily with the highest processing volume of nearly 170 million in a single day. Jushuitan ERP is one of the fastest iterating e-commerce SaaS ERP products in China in terms of the number of iterations, according to CIC. During the track record period, Jushuitan ERP maintained an average response time of less than 50 millisecond and an uptime of more than 99.5%.

On the basis of ERP, Jushuitan has further extended its products and services to other e-commerce operation SaaS products. As of 31 December 2022, it has launched four e-commerce operation SaaS products (exclusive of ERP) such that the company’s SaaS tools are able to serve various needs of e-commerce participants to equip them with capabilities in financial accounting, management reporting and analytics, workflow management, wholesale market procurement, among others.In 2022, customers who purchased two or more of Jushuitan products contributed 30.6% of its total SaaS revenue for the year.

Jushuitan was China’s largest e-commerce SaaS ERP provider in terms of revenue in 2022, with a market share of 20.7%, according to CIC. In China’s e-commerce operation SaaS market, it also ranked first with regard to total SaaS revenue in 2022.

From 2020 to 2022, Jushuitan served 22,600, 33,100 and 45,700 SaaS customers, respectively.

It is worth mentioning that in the two sets of data reflecting the viability of a SaaS company, Jusuitan achieved a relatively impressive result – from 2020 to 2022, the LTV/CAC ratio of Jushuitan was over 6 times, which measures the relationship between customer lifetime value and customer acquisition cost; in 2021 and 2022, the net customer revenue retention rate was 122% and 105%, respectively.