Blue Lake Capital’s USD-denominated fund III topped the list of 「Best Performing Greater China-focused USD-denominated PE & VC Funds」

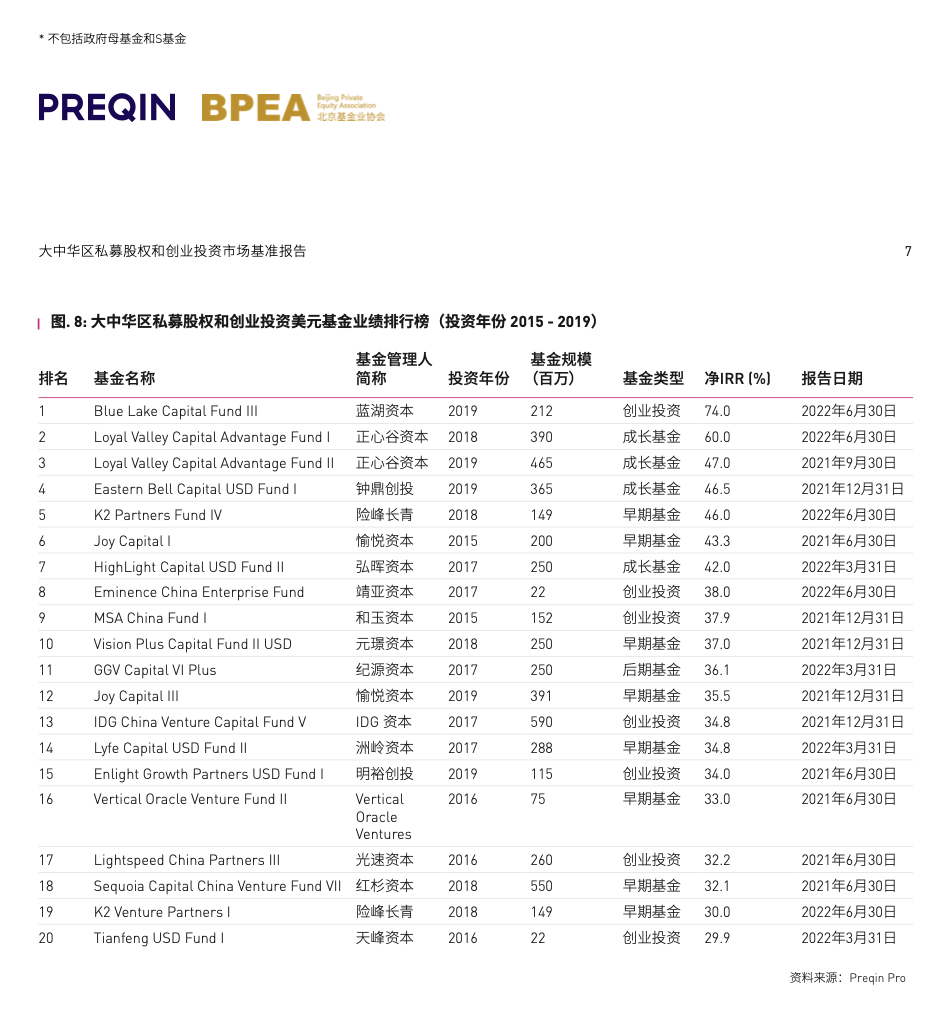

Recently, PREQIN, a renowned data provider and data analysis platform, and Beijing Private Equity Association jointly released the first “Greater China-focused PE & VC Benchmark Report”. Based on the data of 75 fund managers and 210 funds, the report mainly contains performance benchmark data and ranking lists.

The benchmark data aim to provide a range of panoramic metrics showing the overall market performance which is evaluated by net IRR and net multiple. The ranking lists set out best performing fund managers and funds to improve market transparency. The report describes the new landscape and trends of the fund industry in Greater China in an authoritative and systematic way.

According to the report, the strong performance of Blue Lake’s USD-denominated fund III enabled -it to top the list of “Best Performing Greater China-focused USD-denominated PE & VC Funds” for a net IRR of 74%.

As a venture capital fund driven by industry research and industry experience, Blue Lake Capital has been dedicated to smart manufacturing and SaaS with a whole-industry-chain approach. Many Blue Lake’s portfolio companies have become leaders or potential leaders in their industries. The companies include Chaozhuo Aviation Technology (688237.SH), YHDA (301029.SZ), Zhenyun Technology, JST, Moka, Momenta, Raise3D, and Avove Electronic.

Blue Lake Capital will remain optimistic and vibrant and keep on building its soft power. As an investor, entrepreneur, and operator, the firm is committed to making joint efforts with excellent entrepreneurs for the innovation and upgrading of China’s digital industry!

Related Reading

Follow us on Wechat